The Greatest Guide To Offshore Company Formation

Table of ContentsThe Single Strategy To Use For Offshore Company FormationOffshore Company Formation - QuestionsOffshore Company Formation Fundamentals ExplainedThe Greatest Guide To Offshore Company FormationThe 4-Minute Rule for Offshore Company Formation9 Easy Facts About Offshore Company Formation Shown

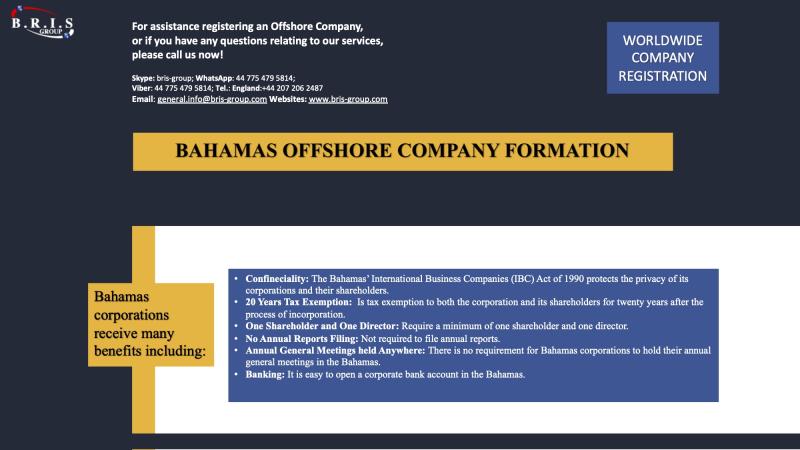

Although tax effectiveness is the primary benefit, proprietors might additionally benefit from lowered overhead. There are typically fewer lawful obligations of managers of an overseas firm. You can also decide to have online workplace services that are both cost-efficient and they also conserve time. It is also commonly easy to set up an offshore company and also the procedure is less complex contrasted to having an onshore business in lots of parts of the globe.If you are a business owner, for circumstances, you can create an overseas company for confidentiality purposes and for convenience of administration. An overseas firm can additionally be utilized to bring out a working as a consultant organization.

The Best Strategy To Use For Offshore Company Formation

The procedure can take as little as 15 minutes. Also before creating an offshore company, it is initially important to recognize why you choose overseas company development to setting up an onshore firm.

If your major go for opening up an offshore business is for personal privacy purposes, you can hide your names making use of nominee solutions. With candidate services, an additional person occupies your role as well as indicators papers on your behalf. This suggests that your identity will remain exclusive. There are several points that you ought to remember when picking an offshore jurisdiction.

The Of Offshore Company Formation

There are quite a variety of overseas territories as well as the whole job of thinking of the very best one can be quite made complex. There are a number of points that you likewise need to take into consideration when choosing an offshore territory. Each area has its very own special benefits. Several of the important things that you need to take into consideration include your residency circumstance, your service as well as your banking demands.

If you established an offshore firm in Hong Kong, you can trade globally without paying any local tax obligations; the only condition is that you ought to not have a source of revenue from Hong Kong. There are no tax obligations on capital gains and investment earnings. The area is likewise politically and you could check here financially stable. offshore company formation.

With so numerous jurisdictions to pick from, you can always find the best area to establish your offshore company. It is, nonetheless, vital to pay attention to information when developing your choice as not all business will certainly enable you to open for savings account and also you need to guarantee you exercise appropriate tax preparation for your regional as well as the international jurisdiction.

The 45-Second Trick For Offshore Company Formation

Company structuring and planning have attained greater degrees of intricacy than ever before while the need for anonymity continues to be solid. Corporations have to keep up as well as be frequently on the lookout for new means to benefit. One method is to have a clear understanding of the qualities of overseas international firms, and also just how they might be placed to advantageous use.

An even more right term to utilize would be tax mitigation or preparation, due to the fact that there are means of mitigating tax obligations without breaking the regulation, whereas tax obligation evasion is normally categorized as a criminal offense. Yes, due to the fact that a lot of countries urge worldwide profession and venture, so there are typically no constraints on homeowners doing organization or having bank accounts in other countries.

Offshore Company Formation - Truths

Sophisticated as well as respectable high-net-worth individuals and also firms routinely utilize offshore investment cars worldwide. Securing assets in mix with a Trust fund, an overseas business can stay clear of high levels of revenue, capital and also death taxes that would certainly or else be payable if the possessions were held straight. It can also secure assets from financial institutions and various other interested events.

If the company shares are held by a Depend on, the possession is legally vested in the trustee, therefore obtaining the potential for even higher tax obligation preparation advantages. Family as well as Safety Trust funds (possibly as an option to a Will) for build-up of financial investment revenue and long-term benefits for recipients on a favorable tax basis (without earnings, inheritance or funding you can find out more gains tax obligations); The sale or probate of residential properties in various countries can become complicated and expensive.

Conduct company without business taxes. Tax obligation places, such as British Virgin Islands, permit the development of International Business that have no tax or reporting obligations.

See This Report on Offshore Company Formation

This permits the charges to build up in a reduced tax territory. International Companies have the same civil liberties as an individual person as well as can make financial investments, deal property, profession portfolios of stocks and bonds, and perform any legal organization tasks so long as these are not done in the nation of registration.